How Equipment Leasing Companies Make Money

Equipment leasing is a highly competitive multi-billion-dollar industry. Since most companies (lessees) choose their leasing company (lessors) largely based on the lease rate offered, the competitive pressures of the market push these rates down. This leaves lessors with smaller traditional profit opportunities and leads them to structure lease contracts to ensure lessor profitability.

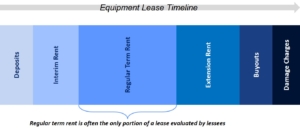

Most lessors earn profit through significant charges outside of the regular term rent stream, including interim rent, retained deposits, fees, lease extensions, non-compliant return charges, fair market value definitions, and end-of-lease buyouts for equipment that cannot be returned.

This guide will examine the key drivers of lessor profitability which allow lessors to offer low rates. We have also created a downloadable PDF version of this for you to share.Download this guide here for free.

Caution: Regular term rent is only a small portion of the all-in cost of your equipment lease

Let’s quickly review the timeline of a typical equipment lease. Regular term rent is often the only portion of a lease evaluated by lessees in a lease vs. buy decision. Lessors commonly securitize the regular term rent portion, which allows them to offer low and attractive rates to the lessee. Focusing only on the regular term rent often makes equipment leasing a very attractive financing alternative. However, there are several other payment obligations under the lease contract outside of regular term rent that help lessors recoup a sizable portion of the original cost of the equipment over time. When left unmonitored, these contractually defined obligations can turn equipment leasing into a problematic and financially draining experience for your business.

Retained Deposits

Be mindful of retainable deposits due at lease signing. Equipment leases often require deposits (typically one month’s base rent) and other upfront fees (commitment fees or restocking fees), and lease agreements often include language that makes these deposits non-refundable under predictable circumstances. You should attempt to eliminate deposits from your contracts or guarantee reasonable deposit refunds, but if you rarely get deposits back, this expense should be included in the all-in cost of leasing.

Interim Rent

When lessors or equipment vendors deliver and install equipment before the commencement date of the lease, lease agreements often allow lessors to charge you for the period between delivery and the lease commencement date. Interim rents are prorated monthly payments charged on partially delivered equipment. Most lessees exclude these additional costs from their lease vs. buy analysis. These rents accrue until all of the equipment has been delivered, and in many cases can last for a year or more before the base term starts. You need to be aware that if the length of the interim rent period is uncapped in the lease agreement, you can be exposed to additional budget-busting costs and you should include this element in the all-in cost of leasing.

Lease Extensions

Lease extensions, renewals, lease rolls, equipment upgrades, and other forms of continued payments are the most common source of lessor profitability. Leasing companies accomplish this goal through carefully crafted contract provisions. Lessors seek to structure lease agreements so that at least some period of lease extensions are probable. Based on prior experience, in a given market of similar client profile, most lessors estimate the approximate number of extension rents a lessee is likely to pay, Beware of notice periods and automatic extension clauses in your lease agreement. One example is that if a lessee does not notify the lessor in writing within a certain period prior to lease end (usually 90-120 days), your contract will automatically renew for another 6 or 12 months.

Non-Compliant Return Charges

Lessors often include “all-but-not-less-than-all” return conditions in the lease agreement, which stipulate that rent for an entire schedule of equipment will continue in full force until every piece of equipment on the schedule is returned (i.e., no partial returns). Such conditions may also include short delivery windows and strict instructions on equipment packaging, which make it extremely difficult, if not impossible, for lessees to execute.

You should approach “all-but-not-less-than-all” terms with extreme caution due to the risks posed by non-compliant return. In addition to leading to long and expensive lease extensions, they can result in substantial fees.

Fair Market Value Definitions

Another pitfall for your business is the failure to adequately define the Fair Market Value (FMV) of the equipment at the end of the lease, which is what you must pay if equipment return is unfeasible and you do not want to extend the lease. If the lease agreement allows the lessor to define FMV at their discretion, you will most likely either have to pay an inflated FMV or continue the lease against your wishes. Even if mutual agreement on FMV is required at that stage, you may be forced to extend the lease because lease rents will continue until mutual agreement is settled. Be mindful of your lease agreement terms and ensure that you have a defined FMV and/or an FMV dispute process outlined prior to signing.

End-of-Lease Buyouts

When lessees are put in a spot where they must either extend leases or pay the often-excessive FMV for the equipment, they sometimes choose the latter. While equipment leasing companies generally prefer lessees to extend leases, they can also profit on the sale of the equipment at a price favorable to them.

Asset prices at the end-of-lease vary depending on the size and duration of the lessee’s portfolio and the lessor’s projected return, rather than being based on the FMV of the assets. The asset price can also vary depending on whether there is a right to a buyout specified in the Master Lease or Schedule and the details of that definition. Asking for the price of buying the equipment at the end of lease is a good way to learn the anticipated end-of-lease cash flow expected by a lessor on an individual transaction. Asking for the price of buying out all active leases is a good way to learn the lessor’s anticipated cash flows for the overall relationship at that point in time. Overall, asset sales to lessees can be a strong driver of the lessor’s return on investment.

Equipment type also plays an important role in the magnitude of lessor profits from these sales. Technology equipment, medical equipment, telecommunications gear, and many other asset types which either decline rapidly in value and/or tend to remain in service past the end of lease are a major source of lessor profit. These assets often produce substantial extension rent streams and lessors commonly assign asset values of 40%–50%+ of original equipment cost of IT assets with little secondary market value for end-of-lease buyouts. These prices are usually negotiable and are typically far below the 40%–200% return some lessors may look for on extended and rolled leases.

Conclusion: Beware of the Hidden Costs and Risks in Your Master Lease Agreement Terms

Equipment lease charges outside the committed base rent stream are rarely considered by lessees when performing a lease vs. buy analysis. Occurring either at the beginning or at the end of lease, these charges drive the lessor financial performance and are the key factors for lessor profitability. It has been a common mistake among lessees to not account for these charges when evaluating the financial performance of equipment leasing.

Equipment lease agreements are complex and understanding the structure of the lease and the hidden risks and costs is crucial for a successful negotiation of your Master Lease and Schedules terms. This can make your equipment sourcing more effective, help you measure and improve the performance of your company’s leasing program, and reduce the all-in cost of your equipment leasing.